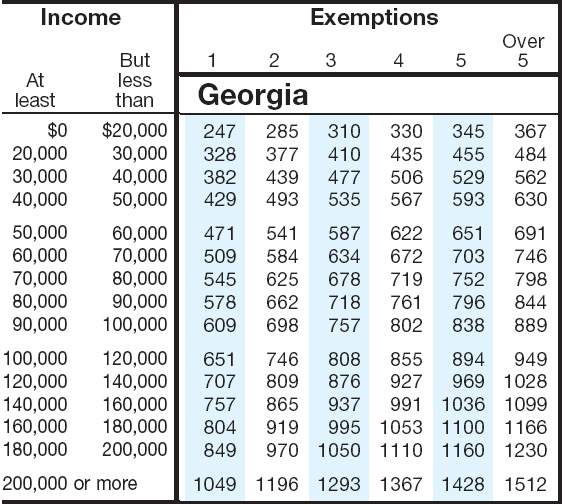

Georgia State Income Tax Rate 2025. Today, july 1, marks the beginning of fiscal year 2025, bringing several major pieces of legislation into effect in georgia. Calculate your income tax, social security and pension.

This tool is freely available and is designed to help you. Find out how much you’ll pay in georgia state income taxes given your annual income.

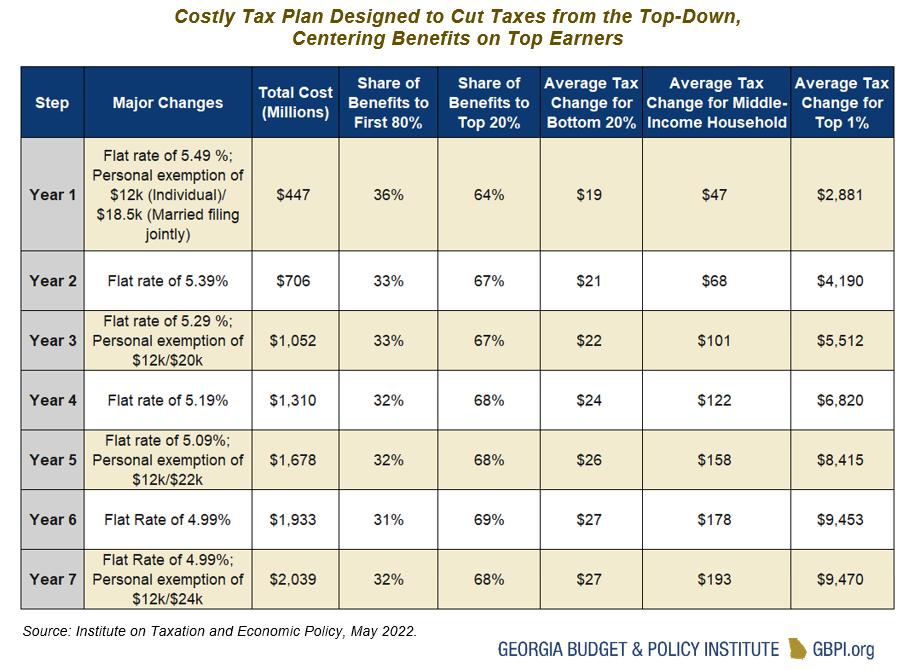

New Tax Plan Risks State’s LongTerm Fiscal Health, Worsens and, The probability georgia will slip into recession is 25%.

Ga State Tax Rate 2025 Rois Vivien, From 2025 to 2029, the rate will gradually be reduced to 4.99% if.

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax, This change affects income earned in 2025, which is reported on state tax returns in 2025.

State Tax Brackets 2025 Kenna Melodee, This change affects income earned in 2025, which is reported on state tax returns in 2025.

Lawmakers Might Come to Regret Risky Tax Plan, Customize using your filing status, deductions, exemptions and more.

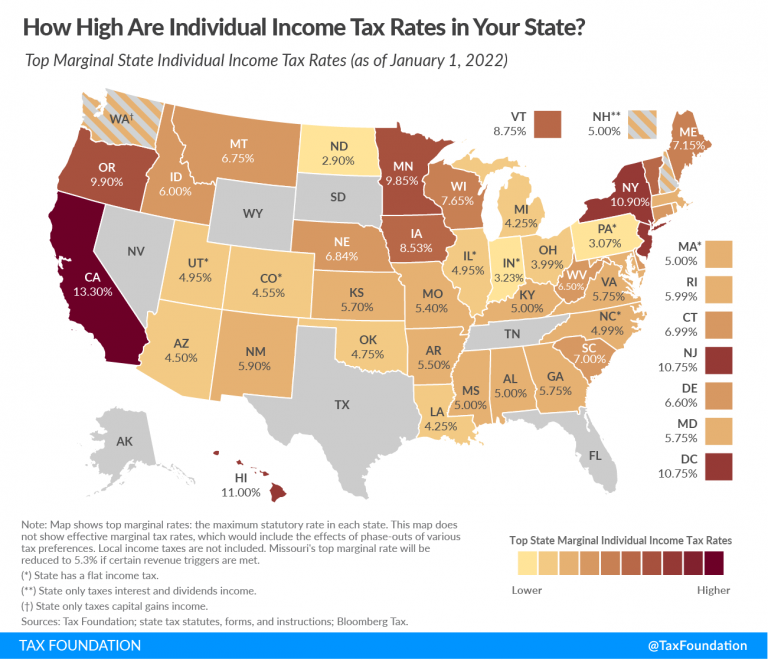

State Tax Rates and Brackets, 2025 Tax Foundation, You can quickly estimate your georgia state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare salaries in georgia and for quickly estimating your tax.

State Tax 2025 2025, Welcome to the 2025 income tax calculator for georgia which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your taxable income in.

Which States Are Best For Retirement? Financial Samurai, Allows general assembly to reduce the income tax rate to 5.5% with the passage of.