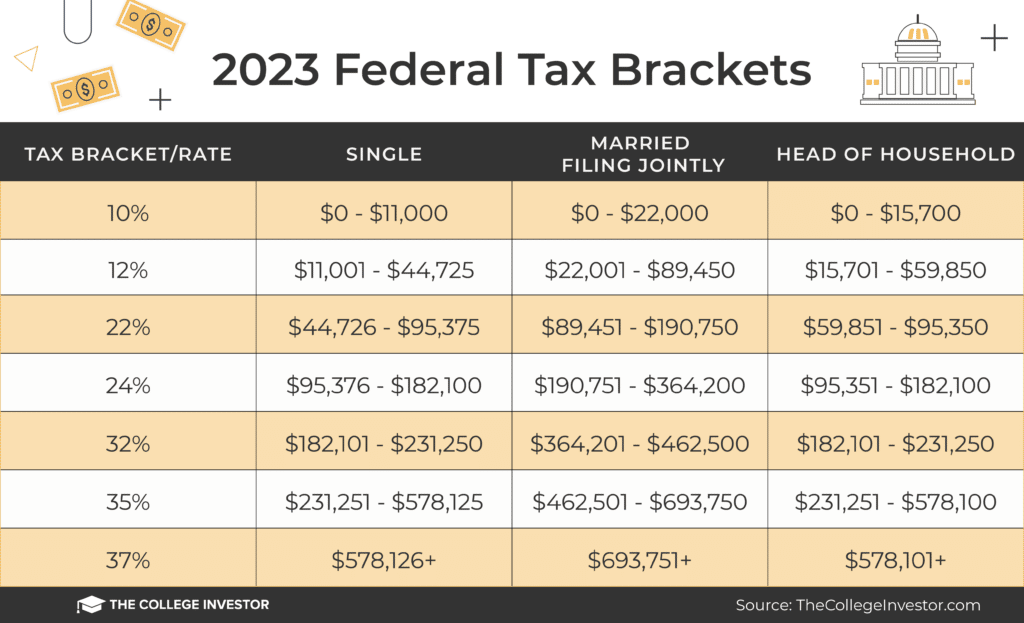

2025 Us Tax Brackets Married Filing Jointly. 6.20% for the employee and 6.2% for employer medicare: The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $626,350 for single filers and above $751,600 for married couples filing jointly.

Your bracket depends on your taxable income and filing status. The standard deduction rises to $15,000 for 2025, an increase of $400.

2025 Tax Brackets Married Filing Jointly Calculator Becki Carolan, * 35% for incomes over $250,525.

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, Here’s how that works for a single person with taxable income of $58,000 per year:

Us Tax Brackets 2025 Married Jointly Vs Separately Karen Smith, Generally, as your income increases, you’ll.

Tax Brackets Married 2025 Gilda Julissa, Here’s how that works for a single person with taxable income of $58,000 per year:

2025 Tax Brackets Married Filing Separately Single Jennifer Grants, $137,000, beginning to phase out at.

Us Tax Brackets 2025 Married Jointly Vs Separately Karen Arnold, Single taxpayers and married individuals filing separately:

What Is The Minimum To File Taxes 2025 Virginia Davidson, To figure out your tax bracket, first look at the rates for the filing status you plan to use:

Tax Table 2025 Married Jointly Hedy Marybelle, Calculate your income tax brackets and rates for 2025 here on efile.com.

Tax Brackets For Married Filing Jointly 2025 Lorrai Nekaiser, This means that if your taxable.

Us 2025 Tax Brackets Calculator Irina Leonora, Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.